Gastric Bypass Life Insurance

Have you previously had Gastric Bypass surgery? Looking for cost effective Gastric Bypass Life Insurance? At Life Insurance Cover we will find the protection you are looking for. Life Insurance Cover compares all of the different Insurers to quickly and easily find cover that protects you.

What Is Gastric Bypass Surgery?

Gastric bypass surgery is a general term for weight loss surgery, also called bariatric or metabolic surgery, is sometimes used as a treatment for people who are very obese. It can lead to significant weight loss and help improve many obesity-related conditions, such as type 2 diabetes or high blood pressure.

But it's a major operation and in most cases should only be considered after trying to lose weight through a healthy diet and exercise.

Who Can Have Weight Loss Surgery?

Weight loss surgery could be a viable option if:

You have a body mass index (BMI) of 40 or more, or a BMI between 35 and 40 and an obesity-related condition that might improve if you lost weight (such as type 2 diabetes or high blood pressure)

You've tried all other weight loss methods, such as dieting and exercise, but have struggled to lose weight or keep it off

You agree to long-term follow-up after surgery – such as making healthy lifestyle changes and attending regular check-ups

Speak to a GP if you think weight loss surgery may be an option for you. You may qualify for NHS treatment, they can refer you for an assessment to check surgery is suitable.

Types Of Weight Loss Surgery

There are several types of weight loss surgery. The most common types are:

Gastric band – a band is placed around your stomach, so you do not need to eat as much to feel full

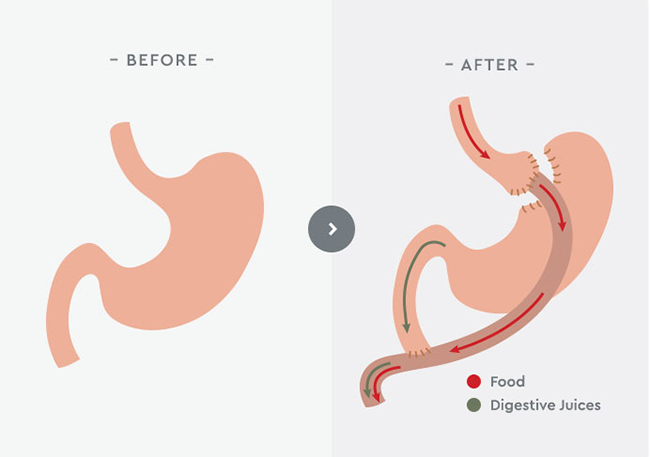

Gastric bypass – the top part of your stomach is joined to the small intestine, so you feel fuller sooner and do not absorb as many calories from food

Sleeve gastrectomy – some of your stomach is removed, so you cannot eat as much as you could before and you'll feel full sooner

All these operations can lead to significant weight loss within a few years, but each has advantages and disadvantages.

Life After Weight Loss Surgery

Weight loss surgery can achieve dramatic weight loss, but it's not a cure for obesity on its own. You will need to commit to making permanent lifestyle changes after surgery to avoid putting weight back on.

These include:

Change your diet – you'll be on a liquid or soft food diet in the weeks after surgery, but will gradually move onto a normal balanced diet that you need to stay on for life

Exercise regularly – once you've recovered from surgery, you'll be advised to start an exercise plan and continue it for life

Attend regular follow-up appointments to check how things are going after surgery and get advice or support if you need it

Risks Of Weight Loss Surgery

Weight loss surgery carries a small risk of complications. These include:

Excess folds of skin – you may need further surgery to remove these and it is not usually available free of charge on the NHS

Not enough vitamins and minerals from your diet – you'll probably need to take supplements for the rest of your life after surgery

Gallstones (small, hard stones that form in the gallbladder)

Blood clots in the leg (deep vein thrombosis) or lungs (pulmonary embolism)

The gastric band slipping out of place, food leaking from the join between the stomach and small intestine, or the gut becoming blocked or narrowed.

Many people who have had Gastric Bypass Surgery have been accepted for life insurance on standard rates. Insurers will however accept applications based on how severe the condition is. By writing to your GP to confirm your treatment and whether there are any medical complications. Also the impact the condition has on their lifestyle and ability to work.

Finding Gastric Bypass Life Insurance

Life Insurance Cover can find the right policy types and protection for you. It can be difficult to find the best Gastric Bypass life insurance cover for your needs, but we can help you.

As Gastric Bypass can cause further long-term conditions that links to other health conditions including blood clots and infections. Some insurers may be wary about accepting applications. All insurers underwrite applications by writing to your GP to confirm treatment and medication. By completing the medical forms from customers looking for Gastric Bypass life insurance. This ensures they manage and assess their level of risk. If you have had complications or secondary medical problems. It can be challenging to know where to find an insurer that can meet your needs.

At Life Insurance Cover our specialist team of advisors and comparison service can help you find the best life insurance that suits your needs. Helping you to compare prices and find the best deal that is within your budget.

Costs For Insurance Premiums

As Gastric Bypass is a linked to potential long-term health conditions, some insurers may charge higher premiums than a person with no health conditions at all. This will depend on keeping your symptoms under control with medications and/or diet or lifestyle. If you have had hospital admissions as a result of Gastric Bypass, your premiums may be higher and an insurer may request some further details from your doctor to determine your premiums.

Prices from insurers will vary depending on who you speak to. As Life Insurance Cover searches all of the UK Life Insurers, we can find the best Gastric Bypass life insurance for you.

At Life Insurance Cover our specialist team of advisors and comparison service can help you find the best FCA-regulated life insurer that suits your needs. Helping you to compare prices and find the best deal that is within your budget.

Who Offers Gastric Bypass Life Insurance?

Life Insurance Cover works with all of the UK’s leading insurers for Gastric Bypass life insurance. Our panel of FCA registered life insurance specialists will provide quotes. We will get a quote from more than one life insurance company and compare the one that is best for you. By submitting your details through our quick and easy online form to receive quotes. Our UK leading FCA-regulated insurance providers will help you to find:

– The best cost per month for Gastric Bypass life insurance

– Protection for complete peace of mind

– An insurer that understands you and your symptoms

Different Protection For Gastric Bypass

Critical illness cover

Critical illness insurance offers protection for many conditions including cancer. If you have had surgery for Gastric Bypass. Acceptance of your application will depend on various factors. This will include your overall health, whether your symptoms are under control. An insurer may want a medical report to review your current treatment. If you have experienced medication complications, you may face higher premiums or may even need to take out a policy with a specialist insurer.

Life Insurance Cover offers to help you find the right cover and take the hassle out of the application process. Simply complete the enquiry form to get a quote. It’s quick, simple and completely free.

For more information on Gastric Bypass:

Do you require life insurance cover? At Life Insurance Cover we take the time to find the best policy and save you money. We also make the purchasing of life insurance as quick and simple as possible. Fill in the easy no obligation enquiry form to speak with member of our specialist team. Get protected with life insurance.